Center for

Financial inclusion

Dismantling Mental Barriers to Wealth

At the Center for Financial Inclusion (CFI), we’re committed to uplifting Black and other systemically disenfranchised communities in the DC Metro Area with the knowledge, tools, and strategies to break through financial barriers and create generational wealth. We are dedicated to addressing the root causes of financial inequities with cultural competence and without judgment. Our mission is to help participants take control of their financial futures and envision a community where wealth-building opportunities are accessible to all. By equipping individuals with the skills to seize opportunities, we’re working toward a prosperous future for generations to come.

Our

Mission

CFI is committed to providing pathways that lead to financial progress and the accumulation of generational wealth for our community members.

Our

Vision

We envision a DC Metro Area where Black and other historically marginalized populations thrive, unimpeded by systemic discrimination, and are enabled to build wealth for themselves and future generations.

Our

Purpose

CFI’s core mission is to equip participants with the skills and knowledge necessary to make critical financial decisions and achieve financial independence.

Our

Services

Financial Empowerment Center Services

- The Financial Empowerment Spark Series

- Financial Empowerment Lab Cohorts

- One-on-One Financial Coaching

Department of Human Services Program

- Career Mobility Action Program

Other Center for Financial Inclusion Services

- Small Group Financial Therapy & Coaching

- Workforce Readiness Spark Series

- Subject-Matter Expert Workshop

- Small Group Workforce Wellness & Coaching

Online Learning Platform

We are the

Center for Financial inclusion

CFI is dedicated to developing lifelong learners who are financially fit, resilient, and able to seize opportunities for growth. We address financial barriers with deep cultural competence and a commitment to addressing root causes of financial disparities. Our approach has already proven successful, with our participants:

understood the neuroscience behind financial decision-making

reported improvement in at least one are of their financial situation

felt more confident in their ability to achieve financial goals.

gained clarity about the root causes of their relationship with money

We provide tools to break financial barriers and build generational wealth.

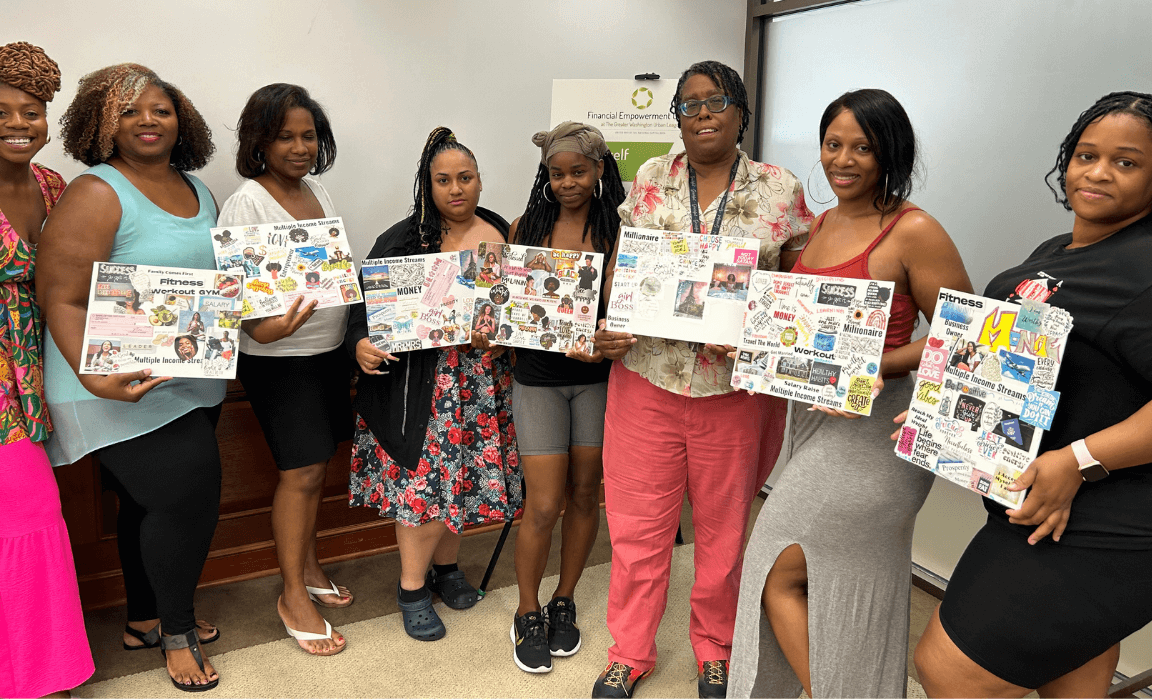

Financial Empowerment Center Services

The Financial Empowerment Spark Series

Discover how financial trauma affects your decision-making and gain essential tools for building wealth. This 10-part online series helps you uncover the root causes of your relationship with money and equips you to take actionable steps toward financial freedom.

Financial Freedom Lab Cohorts

Transform your financial reality through an 8-10 session program designed just for you. Guided by expert financial coaches and therapists, you’ll master topics like credit, savings, debt management, and homeownership. Complete the Spark Series to unlock this next step in your journey.

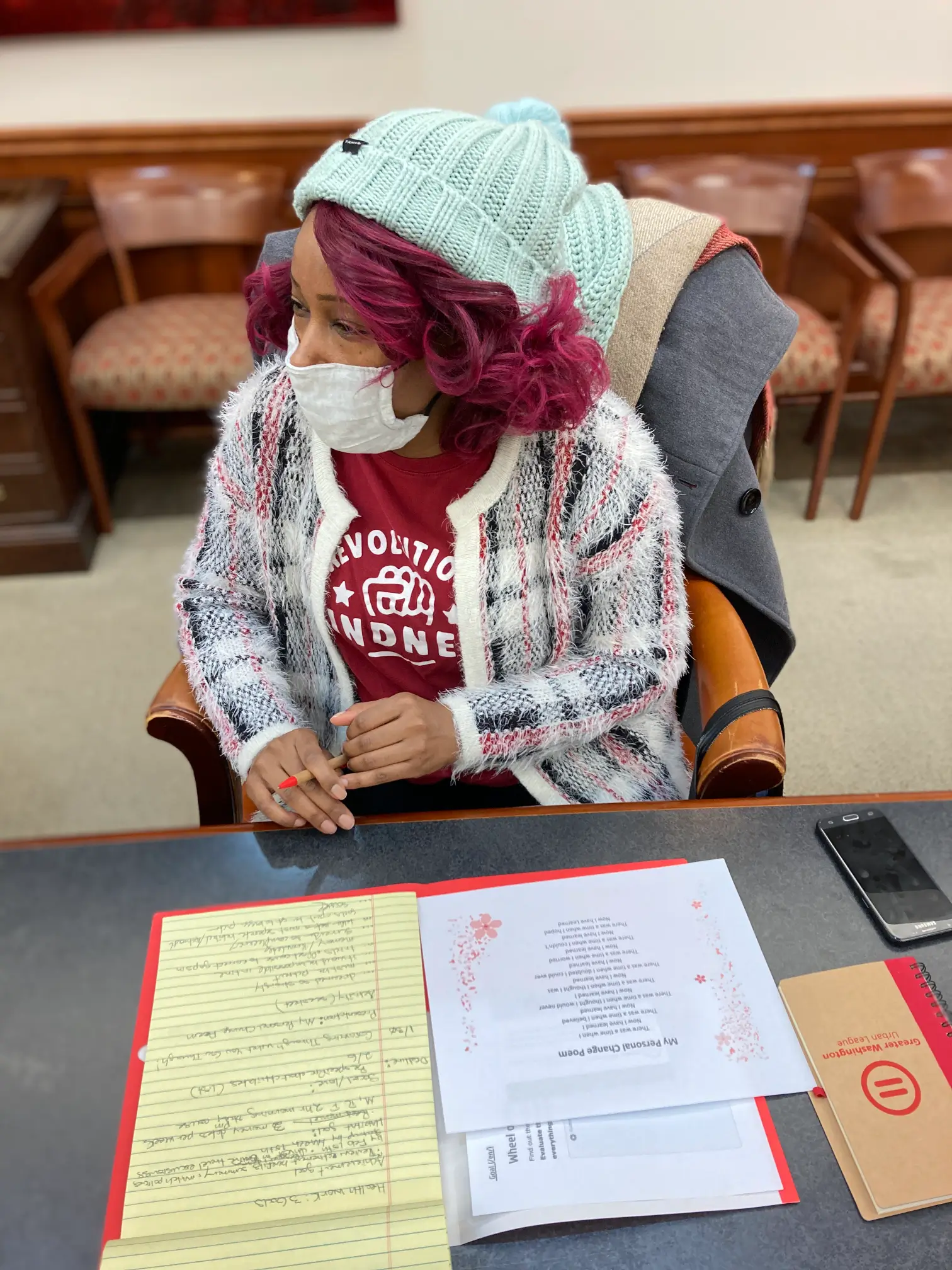

One-on-One Financial Coaching

Get personalized, one-on-one support through in-person or virtual sessions with certified financial coaches and therapists. If you’ve completed the Financial Spark Series and are ready to achieve your financial goals, this coaching is for you. You’ll gain clarity on your goals, develop a practical plan, and receive ongoing support to stay on track. Together, we’ll refine your financial freedom plan, define your goals and timelines, and explore additional resources to help you succeed. Topics include budgeting, credit counseling, housing, entrepreneurship, and more!

Department of Human Services Program

Career Mobility Action Program

This pioneering pilot program helps families who have faced homelessness or are at risk of losing essential benefits due to “benefits cliffs.” It supports families in navigating the challenges of pursuing stable careers while maintaining access to crucial resources, providing tools to break the cycle of poverty and build long-term economic mobility.

Other CFI Services

Small Group Financial Therapy & Coaching

Join a transformative, interactive experience designed to help you address the emotional side of financial decision-making. In a supportive group environment, you’ll work with a financial therapist to tackle financial behaviors, build a healthier relationship with money, and set yourself on the path to financial wellness.

Workforce Readiness Spark Series

This 6-part live, online series is all about helping you navigate your career and boost your employability. You’ll learn skills like personal branding, stress management, and workplace dynamics. By the end, you’ll feel confident and prepared to secure meaningful, stable employment.

Subject-Matter Expert Workshop

Dive deeper into complex financial topics through live webinars led by industry experts. You’ll gain practical insights into estate planning, student loan management, insurance, consumer protection, and more—equipping you with the tools to make informed financial decisions.

Small Group Workforce Wellness & Coaching

Discover how to thrive in your career while maintaining a healthy work-life balance. In this group coaching experience, you’ll learn to handle workplace stress, improve communication, resolve conflicts, and advocate for yourself. Together, we’ll tackle career burnout and prepare you to succeed.

Online Learning Platform

A judgment-free zone where you can build wealth reaching the financial goals you desire!